Business

Sequoia Capital Launches $950M in New Funds Amid Market Shifts

Sequoia Capital has announced the launch of two new early-stage funds totaling $950 million, maintaining its commitment to invest in innovative startups despite recent market volatility. The investment firm, renowned for backing major companies like Airbnb, Google, Nvidia, and Stripe, unveiled a $750 million fund aimed at Series A startups and a $200 million seed fund. This decision reflects Sequoia’s determination to remain steadfast in its investment philosophy, as articulated by partner Bogomil Balkansky.

Sequoia’s announcement comes after a challenging period for the firm, which has undergone significant changes in recent years. In 2021, it revamped its structure into an evergreen main fund supported by specific sub-funds, allowing the firm to retain equity in its portfolio companies long after initial public offerings (IPOs). The firm faced a notable setback in late 2022, losing over $200 million when its investment in the cryptocurrency exchange FTX collapsed. Additionally, in 2023, Sequoia separated from its operations in India and China, further complicating its landscape.

Despite these challenges, Sequoia is refocusing on its core mission: identifying and supporting exceptional founders at the earliest stages of their ventures. “Markets go up and down, but our strategy remains consistent,” Balkansky stated. “We’re always looking for outlier founders with ideas to build generational businesses.” This commitment is especially important as valuations for AI startups continue to soar, making early-stage investments crucial for securing favorable terms.

Investing in Tomorrow’s Leaders

The new funds are designed to capitalize on the growth potential of early-stage companies, particularly in the tech sector. The firm aims to acquire significant ownership stakes at lower prices by investing in promising founders at the start of their journey. Sequoia’s recent investments in companies like Clay, Harvey, n8n, Sierra, and Temporal have already seen considerable returns amid the ongoing AI boom.

Balkansky emphasized the importance of investing even earlier than before, targeting what is now classified as pre-seed funding. Sequoia has recently made initial investments in emerging companies such as Xbow, a security testing startup, and Traversal, an AI reliability firm. These companies have already attracted substantial capital at much higher valuations, reaffirming Sequoia’s strategy.

The firm has also actively supported its portfolio companies behind the scenes. Sequoia facilitated the recruitment of a former Chief Revenue Officer from Databricks to join Xbow’s board. It connected Traversal with over 30 potential customers and arranged a meeting between Reflection AI and Nvidia’s Jensen Huang, leading to a significant $500 million investment from the chipmaker.

Commitment to Legacy and Future Growth

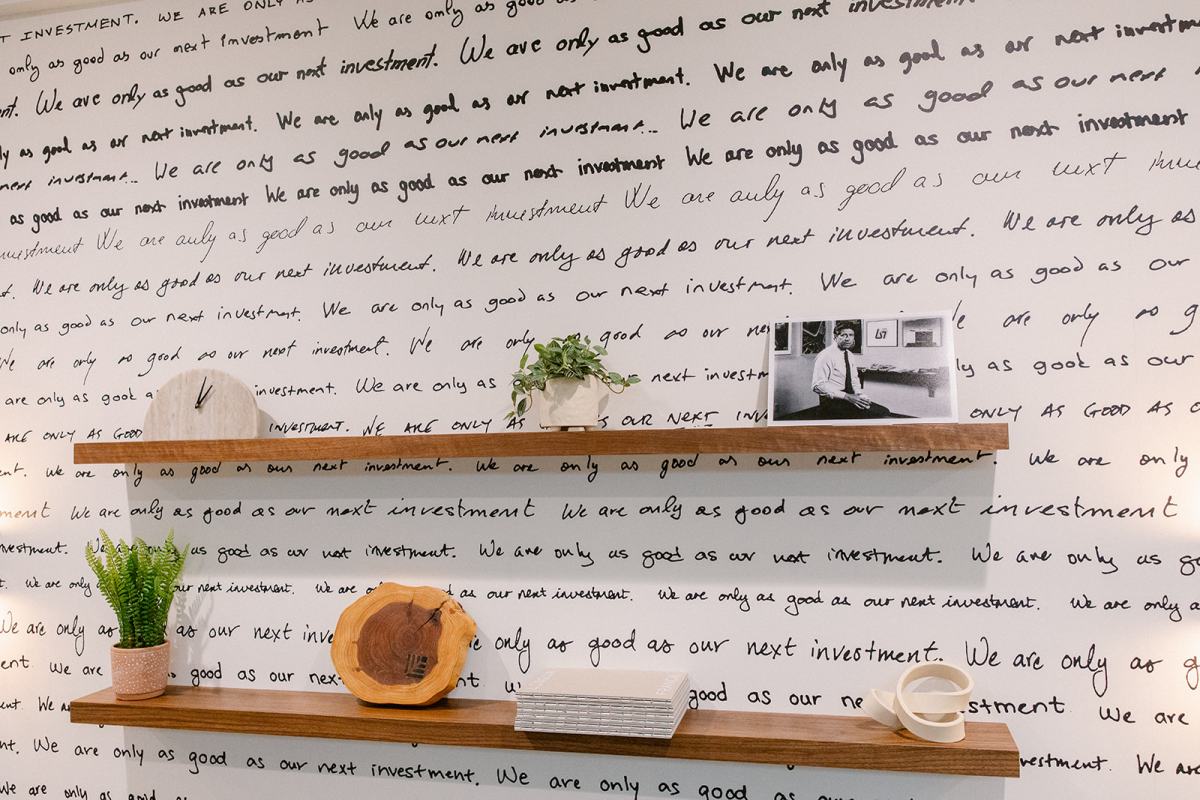

As it navigates the complexities of the current market, Sequoia remains focused on preserving its five-decade legacy as a leading investor in Silicon Valley. The firm’s newly renovated office serves as a constant reminder of this commitment, with a wall displaying the phrase: “We are only as good as our next investment.”

Sequoia Capital’s proactive approach to early-stage investing positions it to continue identifying and nurturing the next wave of groundbreaking companies. As the technology landscape evolves, Sequoia’s dedication to its core principles and innovative funding strategies will play a crucial role in shaping the future of startups.

-

Sports2 weeks ago

Sports2 weeks agoSteve Kerr Supports Jonathan Kuminga After Ejection in Preseason Game

-

Politics2 weeks ago

Politics2 weeks agoDallin H. Oaks Assumes Leadership of Latter-day Saints Church

-

Entertainment2 weeks ago

Entertainment2 weeks agoZoe Saldana Advocates for James Cameron’s Avatar Documentary

-

Business2 weeks ago

Business2 weeks agoTyler Technologies Set to Reveal Q3 2025 Earnings on October 22

-

Science2 weeks ago

Science2 weeks agoChicago’s Viral ‘Rat Hole’ Likely Created by Squirrel, Study Reveals

-

Lifestyle2 weeks ago

Lifestyle2 weeks agoKelsea Ballerini Launches ‘Burn the Baggage’ Candle with Ranger Station

-

Lifestyle2 weeks ago

Lifestyle2 weeks agoDua Lipa Celebrates Passing GCSE Spanish During World Tour

-

World2 weeks ago

World2 weeks agoD’Angelo, Iconic R&B Singer, Dies at 51 After Cancer Battle

-

Business2 weeks ago

Business2 weeks agoMLB Qualifying Offer Jumps to $22.02 Million for 2024

-

Health2 weeks ago

Health2 weeks agoRichard Feldman Urges Ban on Menthol in Cigarettes and Vapes

-

Health2 weeks ago

Health2 weeks agoCommunity Unites for Seventh Annual Mental Health Awareness Walk

-

Sports2 weeks ago

Sports2 weeks agoPatriots Dominate Picks as Raiders Fall in Season Opener