Business

Fluor Inc. Shares Drop Despite Monthly Gains, P/E Ratio Raises Questions

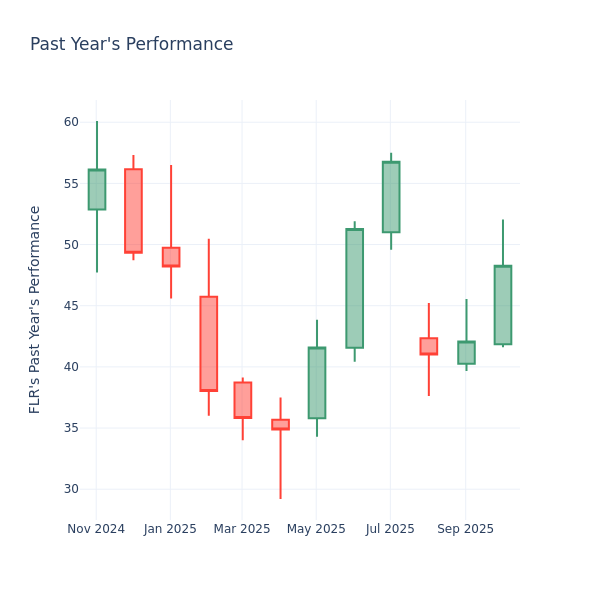

Fluor Inc. (NYSE: FLR) experienced a decline in its share price, currently at $48.22 following a 1.17% drop in the latest market session. Despite a monthly increase of 11.92%, the stock has seen an overall decrease of 8.60% over the past year. This mixed performance prompts long-term investors to closely examine the company’s price-to-earnings (P/E) ratio, a critical metric for assessing market valuation.

Understanding Fluor’s P/E Ratio

The P/E ratio serves as a benchmark for investors, allowing them to compare a company’s market performance against broader market data, historical earnings, and industry standards. Currently, Fluor’s P/E ratio stands at 2.02, which is significantly lower than the average P/E ratio of 43.63 in the Construction & Engineering sector. A lower P/E could suggest that shareholders expect the stock to underperform compared to its peers. Alternatively, it may indicate that the company is undervalued.

While a low P/E ratio can be an attractive signal for potential investors, it also raises questions about Fluor’s growth prospects and financial stability. Evaluating this ratio in isolation may lead to misguided investment decisions, as it is only one aspect of a company’s overall financial health.

Investors are encouraged to adopt a comprehensive approach when assessing Fluor’s market position. This includes analyzing other financial metrics, industry trends, and qualitative factors. A well-rounded evaluation can provide a clearer picture of the company’s potential and guide investors toward more informed decisions.

Implications for Investors

As Fluor Inc. navigates its recent challenges, long-term shareholders should consider the implications of the current P/E ratio alongside other factors. The recent drop in share price, despite positive short-term performance, suggests volatility that investors cannot ignore.

The market’s perception of Fluor may change as the company addresses its performance issues and aligns with industry trends. Investors should remain vigilant and informed, using various analytical tools to navigate the complexities of the market.

In conclusion, while a low P/E ratio can indicate potential undervaluation, it is essential not to overlook other financial indicators that contribute to a company’s overall health. By keeping a holistic view, investors can enhance their decision-making processes and increase the likelihood of favorable outcomes in their investment journey.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

-

Sports2 weeks ago

Sports2 weeks agoSteve Kerr Supports Jonathan Kuminga After Ejection in Preseason Game

-

Top Stories6 days ago

Top Stories6 days agoMarc Buoniconti’s Legacy: 40 Years Later, Lives Transformed

-

Science2 weeks ago

Science2 weeks agoChicago’s Viral ‘Rat Hole’ Likely Created by Squirrel, Study Reveals

-

Politics2 weeks ago

Politics2 weeks agoDallin H. Oaks Assumes Leadership of Latter-day Saints Church

-

Business2 weeks ago

Business2 weeks agoTyler Technologies Set to Reveal Q3 2025 Earnings on October 22

-

Lifestyle2 weeks ago

Lifestyle2 weeks agoKelsea Ballerini Launches ‘Burn the Baggage’ Candle with Ranger Station

-

Lifestyle2 weeks ago

Lifestyle2 weeks agoDua Lipa Celebrates Passing GCSE Spanish During World Tour

-

Entertainment2 weeks ago

Entertainment2 weeks agoZoe Saldana Advocates for James Cameron’s Avatar Documentary

-

Sports2 weeks ago

Sports2 weeks agoPatriots Dominate Picks as Raiders Fall in Season Opener

-

Health2 weeks ago

Health2 weeks agoRichard Feldman Urges Ban on Menthol in Cigarettes and Vapes

-

Health2 weeks ago

Health2 weeks agoCommunity Unites for Seventh Annual Mental Health Awareness Walk

-

World2 weeks ago

World2 weeks agoD’Angelo, Iconic R&B Singer, Dies at 51 After Cancer Battle