Health

U.S. Hospitals Face Financial Strain as Operating Margins Hit 1.1%

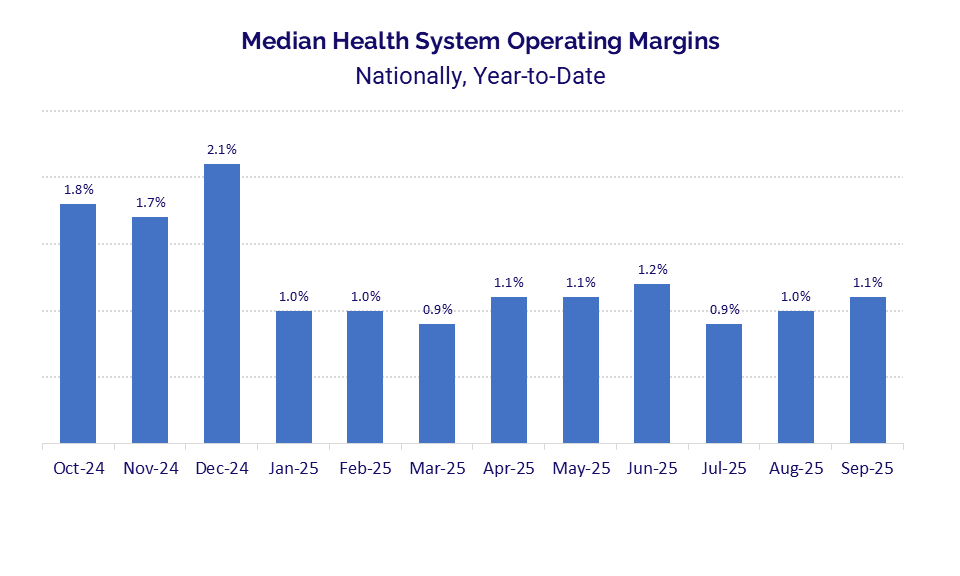

U.S. healthcare organizations grappled with persistent financial challenges at the end of the third quarter of 2025. Despite a slight increase in gross revenue, operating margins remained remarkably thin, recorded at just 1.1% in September, according to recent data from Strata Decision Technology. This figure reflects the ongoing financial strain experienced by hospitals throughout the year.

Expense Pressures Continue to Rise

The primary factor contributing to the weak financial performance of hospitals is the rapid escalation of non-labor expenses. These costs have surged, particularly in the areas of supplies and pharmaceuticals. Specifically, drug expenses witnessed a significant year-over-year (YOY) increase of 12.8%, while supply costs rose by 12.1% from September 2024 to September 2025. Overall, total non-labor expenses increased by 9.3% YOY, outpacing the 5.0% rise in total labor expenses. Consequently, total hospital expenses climbed by 7.5% YOY by the end of the third quarter.

Regional disparities in financial pressures have also emerged. Hospitals in the Midwest faced the steepest YOY increases in drug expenses, soaring by 17.3%. The West followed closely with a 15.7% increase.

“Operating margins have faltered throughout the first three quarters of 2025 as healthcare organizations feel the full weight of rising expenses,” stated Steve Wasson, Chief Data and Intelligence Officer at Strata Decision Technology. He emphasized the need for organizations to effectively manage expenses to maintain performance amid economic challenges.

Outpatient Care Drives Revenue Growth

While expenses continued to rise, a notable shift in patient care preferences has led to significant revenue growth for some healthcare providers. Outpatient visits surged nationally by 9.8% YOY in September, with the South and Midwest leading in this increase. In contrast, inpatient admissions rose by 5.3%, and observation visits saw a modest increase of 1.5%. Emergency visits, however, experienced a slight decline of 0.5%.

These trends in patient care utilization are reflected in gross operating revenue, which increased by 11.4% YOY. This rise was driven by a 12.8% increase in outpatient revenue and a 9.8% rise in inpatient revenue.

In a positive development, physician practices reported the first signs of financial relief in 2025. The median investment required to support practice operations decreased for the first time, dropping to $311,264 per physician full-time equivalent (FTE) in the third quarter. This figure represents a 4.7% decrease from the previous quarter and a 1.8% decline compared to Q3 2024. While median total expenses per physician FTE remained elevated at approximately $1.1 million—a 3.9% YOY increase—they did decline by 1.3% from Q2 2025.

The data referenced in this report is drawn from Strata’s StrataSphere® database and Comparative Analytics, encompassing over 650 hospitals and 135,000 physicians, representing roughly 25% of all provider spending in the U.S. healthcare landscape. These figures underscore the ongoing challenges and shifts facing the healthcare sector as it navigates a complex financial landscape.

-

Sports3 weeks ago

Sports3 weeks agoSteve Kerr Supports Jonathan Kuminga After Ejection in Preseason Game

-

Top Stories2 weeks ago

Top Stories2 weeks agoMarc Buoniconti’s Legacy: 40 Years Later, Lives Transformed

-

Science3 weeks ago

Science3 weeks agoChicago’s Viral ‘Rat Hole’ Likely Created by Squirrel, Study Reveals

-

Politics3 weeks ago

Politics3 weeks agoDallin H. Oaks Assumes Leadership of Latter-day Saints Church

-

Lifestyle3 weeks ago

Lifestyle3 weeks agoKelsea Ballerini Launches ‘Burn the Baggage’ Candle with Ranger Station

-

Entertainment3 weeks ago

Entertainment3 weeks agoZoe Saldana Advocates for James Cameron’s Avatar Documentary

-

Business3 weeks ago

Business3 weeks agoTyler Technologies Set to Reveal Q3 2025 Earnings on October 22

-

Lifestyle3 weeks ago

Lifestyle3 weeks agoDua Lipa Celebrates Passing GCSE Spanish During World Tour

-

Health3 weeks ago

Health3 weeks agoCommunity Unites for Seventh Annual Mental Health Awareness Walk

-

Health3 weeks ago

Health3 weeks agoRichard Feldman Urges Ban on Menthol in Cigarettes and Vapes

-

Business3 weeks ago

Business3 weeks agoMLB Qualifying Offer Jumps to $22.02 Million for 2024

-

Sports3 weeks ago

Sports3 weeks agoPatriots Dominate Picks as Raiders Fall in Season Opener