Top Stories

Urgent Alert: New Jersey Ghost Tapping Scam Steals Card Info

UPDATE: A shocking new scam known as “ghost tapping” is targeting New Jersey shoppers, potentially draining their bank accounts without any physical contact. Fraudsters are able to steal your card information just by being within a few feet of you, raising urgent concerns among consumers and experts alike.

According to the Better Business Bureau, this tap-to-pay fraud scheme is alarmingly effective. Scammers exploit digital wallets by using concealed card readers, referred to as ghost phones, to extract sensitive financial information from unsuspecting victims. Paul Oster, president of the credit management firm Better Qualified in Eatontown, warns that these cyber thieves can commit millions in retail fraud by simply standing next to their targets in crowded locations.

“The scammers are stealing credit cards that a person has in a digital wallet, putting that information into a ghost phone, and then using that ghost phone at point-of-sale retail stores,” Oster explained. This new method of theft allows criminals to instantly access funds without any direct interaction with the cardholder.

As this scam grows in scope, it is drawing in international criminals who travel under the guise of tourists. They utilize ghost phones to commit fraud in various countries, often selling stolen merchandise on the black market or trafficking it back home.

So, what can New Jersey shoppers do to protect themselves from this alarming trend? Oster recommends avoiding tap-to-pay options altogether. Instead, revert to traditional methods like swiping or inserting cards at the checkout. “If you tap to pay and the merchant is part of this scam, they just stole your information,” he cautioned.

To further safeguard against ghost tapping, here are essential tips to stay ahead of digital thieves:

– Always verify the merchant before making a payment. If unfamiliar, skip tapping.

– Double-check payment details, including the merchant’s name and transaction amount, before confirming payment.

– Use RFID-blocking sleeves for your debit and credit cards to prevent unauthorized scanning.

– Set up transaction alerts with your bank to receive real-time notifications for every charge.

– Never share verification codes with anyone, regardless of how official they may appear.

– Remain vigilant against phishing attempts through emails, texts, and social media designed to extract personal information.

“I don’t say tap-to-pay anymore. I say it’s tap-to-pray,” Oster quipped, emphasizing the gravity of the situation.

New Jersey residents are urged to remain cautious and spread awareness about this growing threat. The potential for financial loss is significant, and understanding how these scams operate is crucial for protection.

Stay informed and share this urgent update with friends and family to help combat ghost tapping and safeguard your financial information.

-

Science2 months ago

Science2 months agoUniversity of Hawaiʻi Joins $25.6M AI Project to Monitor Disasters

-

Business2 months ago

Business2 months agoForeign Inflows into Japan Stocks Surge to ¥1.34 Trillion

-

Top Stories2 months ago

Top Stories2 months agoBOYNEXTDOOR’s Jaehyun Faces Backlash Amid BTS-TWICE Controversy

-

World2 months ago

World2 months agoBoeing’s Merger with McDonnell Douglas: A Strategic Move Explained

-

Top Stories2 months ago

Top Stories2 months agoCarson Wentz Out for Season After Shoulder Surgery: Urgent Update

-

Top Stories2 months ago

Top Stories2 months agoMarc Buoniconti’s Legacy: 40 Years Later, Lives Transformed

-

Entertainment2 months ago

Entertainment2 months agoSydney Sweeney Embraces Body Positivity Amid Hollywood Challenges

-

Lifestyle2 months ago

Lifestyle2 months agoKelsea Ballerini Launches ‘Burn the Baggage’ Candle with Ranger Station

-

Health2 months ago

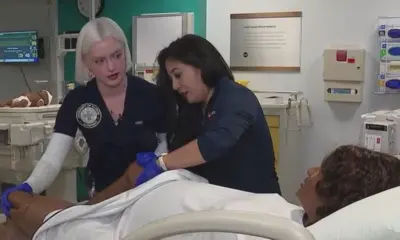

Health2 months agoInnovative Surgery Restores Confidence for Breast Cancer Patients

-

Sports2 months ago

Sports2 months agoSteve Kerr Supports Jonathan Kuminga After Ejection in Preseason Game

-

Entertainment2 months ago

Entertainment2 months agoZoe Saldana Advocates for James Cameron’s Avatar Documentary

-

Science2 months ago

Science2 months agoChicago’s Viral ‘Rat Hole’ Likely Created by Squirrel, Study Reveals