Top Stories

Gen Z Outpaces Boomers in Retirement Savings, Says Vanguard

URGENT UPDATE: A groundbreaking analysis from Vanguard reveals that Gen Z is outpacing older generations in retirement savings, challenging long-held perceptions about their financial habits. This study confirms that nearly 50% of Gen Z workers are on track for retirement, surpassing the 40% of baby boomers and 42% of millennials.

Vanguard’s report highlights a significant shift in financial preparedness among the youngest adult generation, born between 1997 and 2012. While older generations have been criticized for their financial stability, Gen Z is showing remarkable saving practices. Despite facing challenges like student loan debt and a volatile job market, they are effectively leveraging defined contribution retirement plans.

The report states, “DC plans are especially helpful for younger workers, who benefit the most from potential long-term compounding.” The findings suggest that universal access to these plans could increase the share of Gen Z workers on track for retirement by an astonishing 47 percentage points.

In stark contrast, the median worker with access to a defined contribution plan had $83,000 in non-housing net wealth in 2022, compared to a mere $13,000 for those without access. These figures underscore the vital role that structured savings plans play in securing financial futures.

The implications are profound. As older Americans increasingly struggle with retirement savings, Gen Z appears poised to thrive. Analysts warn, however, that managing debt levels will be critical for this generation to maintain their advantageous position.

As the financial landscape evolves, Gen Z’s proactive approach to savings could redefine the narrative surrounding their financial futures. This study serves as a beacon of hope in an era where many young adults are concerned about their economic security.

Authorities and financial experts will be closely monitoring these trends in the coming months. Will this newfound financial prowess translate into a robust retirement for Gen Z? The world is watching as these young savers chart a course toward financial stability, marking a significant moment in generational wealth dynamics.

Stay tuned for more updates on this developing story.

-

Top Stories2 weeks ago

Top Stories2 weeks agoMarc Buoniconti’s Legacy: 40 Years Later, Lives Transformed

-

Sports3 weeks ago

Sports3 weeks agoSteve Kerr Supports Jonathan Kuminga After Ejection in Preseason Game

-

Science3 weeks ago

Science3 weeks agoChicago’s Viral ‘Rat Hole’ Likely Created by Squirrel, Study Reveals

-

Entertainment3 weeks ago

Entertainment3 weeks agoZoe Saldana Advocates for James Cameron’s Avatar Documentary

-

Business3 weeks ago

Business3 weeks agoTyler Technologies Set to Reveal Q3 2025 Earnings on October 22

-

Health2 weeks ago

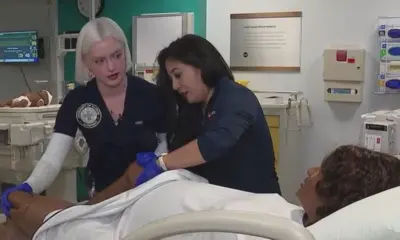

Health2 weeks agoInnovative Surgery Restores Confidence for Breast Cancer Patients

-

Politics3 weeks ago

Politics3 weeks agoDallin H. Oaks Assumes Leadership of Latter-day Saints Church

-

Lifestyle3 weeks ago

Lifestyle3 weeks agoKelsea Ballerini Launches ‘Burn the Baggage’ Candle with Ranger Station

-

Health3 weeks ago

Health3 weeks agoCommunity Unites for Seventh Annual Mental Health Awareness Walk

-

Health2 weeks ago

Health2 weeks ago13-Year-Old Hospitalized After Swallowing 100 Magnets

-

Lifestyle3 weeks ago

Lifestyle3 weeks agoDua Lipa Celebrates Passing GCSE Spanish During World Tour

-

Health3 weeks ago

Health3 weeks agoRichard Feldman Urges Ban on Menthol in Cigarettes and Vapes