Top Stories

RBA Holds Rates Steady, Signals Potential Easing Ahead

UPDATE: The Reserve Bank of Australia (RBA) has just announced a significant shift in its monetary policy stance. In the minutes from its recent meeting on November 3-4, 2023, the RBA indicated that it may keep the cash rate at 3.6% for a longer period, depending on incoming economic data.

The RBA’s latest insights reveal a nuanced approach to interest rates, signaling that they could remain unchanged if economic indicators outperform expectations. However, the bank also acknowledged scenarios where further easing might be necessary if growth weakens. This marks a pivotal moment for the Australian economy as officials balance the need for stability against rising inflation pressures.

Key discussions within the RBA highlighted a “slightly restrictive” cash rate, although recent trends in housing credit and robust consumer demand suggest a potential shift in this assessment. Following three rate cuts earlier this year, the decision to hold rates steady in November reflects concerns over higher inflation and a revitalized housing market.

The RBA stated, “We can afford to be patient while assessing new data on spare capacity and the labour market,” indicating a cautious but proactive stance. Notably, the latest report points to “a little more” underlying inflationary pressure than previously expected, with inflation projected to remain above the 2–3% target band until mid-2026.

The labour market’s dynamics have also changed following a surge in employment, driving the unemployment rate down to 4.3%. This improvement has led markets to recalibrate expectations for further rate cuts, reflecting a growing confidence in Australia’s economic resilience.

In their analysis, RBA officials also noted that the Australian dollar is currently near its estimated fair value. While global growth is anticipated to slow in the latter half of 2025, the RBA pointed out that global downside risks have lessened, offering a cautiously optimistic outlook.

As the economy evolves, all eyes will remain on the RBA’s next moves. Investors and consumers alike should stay alert for further developments, particularly regarding growth indicators and labour market trends. The RBA’s commitment to monitoring these factors closely could have significant implications for future interest rate adjustments.

The implications of these decisions are far-reaching, affecting everything from mortgage rates to consumer spending. With inflationary pressures and a recovering housing market at play, the RBA’s policies will be critical in shaping Australia’s economic landscape in the months to come.

Stay tuned for more updates as this story develops, and watch for the RBA’s next steps in navigating these turbulent economic waters.

-

Science2 weeks ago

Science2 weeks agoUniversity of Hawaiʻi Joins $25.6M AI Project to Monitor Disasters

-

Business3 weeks ago

Business3 weeks agoForeign Inflows into Japan Stocks Surge to ¥1.34 Trillion

-

Top Stories3 weeks ago

Top Stories3 weeks agoBOYNEXTDOOR’s Jaehyun Faces Backlash Amid BTS-TWICE Controversy

-

Top Stories3 weeks ago

Top Stories3 weeks agoMarc Buoniconti’s Legacy: 40 Years Later, Lives Transformed

-

Health4 weeks ago

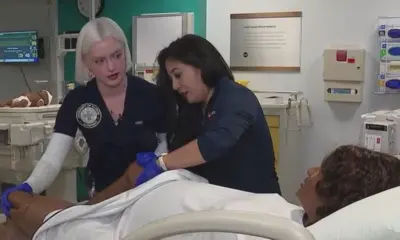

Health4 weeks agoInnovative Surgery Restores Confidence for Breast Cancer Patients

-

Sports1 month ago

Sports1 month agoSteve Kerr Supports Jonathan Kuminga After Ejection in Preseason Game

-

Top Stories3 weeks ago

Top Stories3 weeks agoCarson Wentz Out for Season After Shoulder Surgery: Urgent Update

-

Science1 month ago

Science1 month agoChicago’s Viral ‘Rat Hole’ Likely Created by Squirrel, Study Reveals

-

Entertainment1 month ago

Entertainment1 month agoZoe Saldana Advocates for James Cameron’s Avatar Documentary

-

Lifestyle1 month ago

Lifestyle1 month agoKelsea Ballerini Launches ‘Burn the Baggage’ Candle with Ranger Station

-

Politics1 month ago

Politics1 month agoDallin H. Oaks Assumes Leadership of Latter-day Saints Church

-

Lifestyle1 month ago

Lifestyle1 month agoDua Lipa Celebrates Passing GCSE Spanish During World Tour