World

BOE’s Chief Economist Calls for Caution in Future Rate Cuts

The Chief Economist of the Bank of England (BOE), Huw Pill, has urged a more cautious approach to future interest rate cuts, emphasizing the need to address persistent high inflation rates. His comments reflect growing concerns among policymakers about the economic landscape as the BOE navigates its monetary policy strategy.

In a recent statement, Pill highlighted the importance of balancing the pace of rate reductions with the realities of inflation, which remains stubbornly elevated. He suggested that any decisions regarding rate cuts should be made with careful consideration of economic indicators and potential risks.

Inflation Remains a Key Concern

The BOE has faced significant pressure to adjust interest rates in response to fluctuating economic conditions. As inflation rates linger above target levels, Pill indicated that a rushed approach to cutting rates could jeopardize the fragile economic recovery. He underscored the necessity for the Monetary Policy Committee to take a measured stance, taking into account the broader implications of their decisions on inflation.

According to recent data, the inflation rate in the United Kingdom remains above 4%, significantly higher than the BOE’s target of 2%. This persistent inflationary pressure complicates the central bank’s efforts to stimulate economic growth while ensuring price stability.

Market Reactions and Future Implications

Financial markets have reacted to Pill’s remarks by adjusting their expectations for future interest rate movements. Investors are now weighing the possibility of a more gradual approach to rate cuts, which could influence borrowing costs and consumer spending. Analysts suggest that a cautious stance could help maintain confidence in the UK economy, especially as external factors, such as global supply chain disruptions, continue to exert pressure on prices.

The BOE’s next monetary policy meeting is scheduled for November 2, 2023, where further discussions on interest rates and inflation management are expected. As the central bank grapples with these challenges, Pill’s call for prudence highlights the delicate balance required to foster economic stability.

In summary, Huw Pill of the BOE has articulated a clear message regarding the need for caution in approaching future interest rate cuts. As inflationary pressures persist and the economic environment remains uncertain, the BOE is faced with the critical challenge of navigating these complexities effectively.

-

Science2 months ago

Science2 months agoUniversity of Hawaiʻi Joins $25.6M AI Project to Monitor Disasters

-

Business2 months ago

Business2 months agoForeign Inflows into Japan Stocks Surge to ¥1.34 Trillion

-

Top Stories2 months ago

Top Stories2 months agoBOYNEXTDOOR’s Jaehyun Faces Backlash Amid BTS-TWICE Controversy

-

World2 months ago

World2 months agoBoeing’s Merger with McDonnell Douglas: A Strategic Move Explained

-

Top Stories2 months ago

Top Stories2 months agoCarson Wentz Out for Season After Shoulder Surgery: Urgent Update

-

Entertainment2 months ago

Entertainment2 months agoSydney Sweeney Embraces Body Positivity Amid Hollywood Challenges

-

Top Stories2 months ago

Top Stories2 months agoMarc Buoniconti’s Legacy: 40 Years Later, Lives Transformed

-

Lifestyle2 months ago

Lifestyle2 months agoKelsea Ballerini Launches ‘Burn the Baggage’ Candle with Ranger Station

-

Health2 months ago

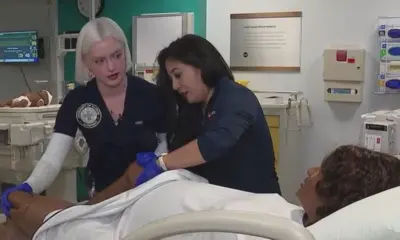

Health2 months agoInnovative Surgery Restores Confidence for Breast Cancer Patients

-

Sports2 months ago

Sports2 months agoSteve Kerr Supports Jonathan Kuminga After Ejection in Preseason Game

-

Entertainment2 months ago

Entertainment2 months agoZoe Saldana Advocates for James Cameron’s Avatar Documentary

-

Lifestyle2 months ago

Lifestyle2 months agoDua Lipa Celebrates Passing GCSE Spanish During World Tour