Top Stories

Japan’s October Services PPI Stalls at 2.7%, Rate Hikes Loom

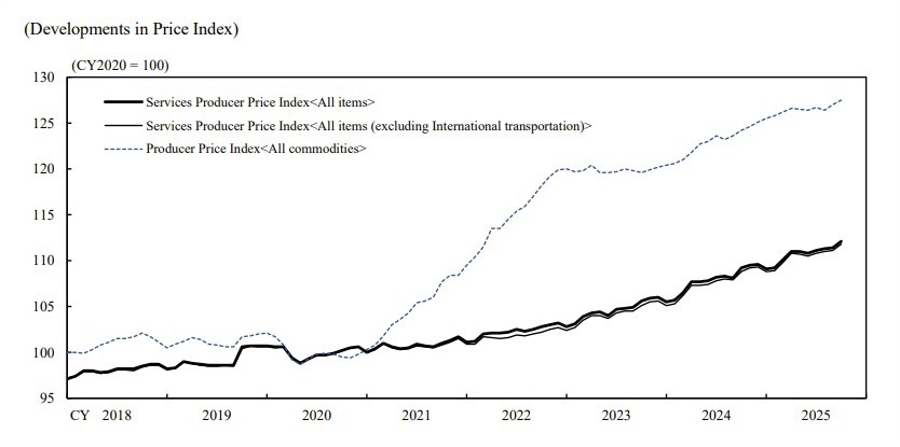

UPDATE: Japan’s Services Producer Price Index (PPI) for October 2025 has been confirmed at 2.7%, matching expectations but down from the 3.0%% recorded previously. This development raises urgent questions about potential interest rate hikes from the Bank of Japan (BoJ).

This crucial economic indicator, released earlier today, holds significant implications for Japan’s monetary policy as inflationary pressures continue to shape the economic landscape. With the Services PPI maintaining a steady rate, the BoJ is now faced with critical decisions regarding its approach to interest rates that could affect millions of consumers and businesses.

The 2.7% figure aligns with analysts’ forecasts, but the dip from 3.0%% is indicative of a cooling trend that the BoJ will need to navigate carefully. The central bank has been under pressure to adjust its policies in response to fluctuating inflation rates and economic growth metrics.

Why does this matter now? As inflation rates influence the purchasing power of consumers and the operational costs for businesses, the BoJ’s response to this data could directly impact Japan’s economy. If the BoJ decides to implement rate hikes, it could lead to increased borrowing costs, affecting everything from home mortgages to business loans.

Market analysts are closely monitoring this situation. The upcoming weeks are critical as the BoJ will hold its policy meeting, where officials may deliberate on the future trajectory of interest rates based on this PPI data. Investors and economists will be looking for signals that could indicate shifts in monetary policy.

Stay tuned for further updates as this story develops—Japan’s economic policy is at a pivotal moment, and the decisions made in the coming days could have lasting repercussions both domestically and internationally.

-

Science4 weeks ago

Science4 weeks agoUniversity of Hawaiʻi Joins $25.6M AI Project to Monitor Disasters

-

Business1 month ago

Business1 month agoForeign Inflows into Japan Stocks Surge to ¥1.34 Trillion

-

Top Stories1 month ago

Top Stories1 month agoBOYNEXTDOOR’s Jaehyun Faces Backlash Amid BTS-TWICE Controversy

-

Top Stories1 month ago

Top Stories1 month agoCarson Wentz Out for Season After Shoulder Surgery: Urgent Update

-

Top Stories1 month ago

Top Stories1 month agoMarc Buoniconti’s Legacy: 40 Years Later, Lives Transformed

-

Health1 month ago

Health1 month agoInnovative Surgery Restores Confidence for Breast Cancer Patients

-

Lifestyle2 months ago

Lifestyle2 months agoKelsea Ballerini Launches ‘Burn the Baggage’ Candle with Ranger Station

-

Sports2 months ago

Sports2 months agoSteve Kerr Supports Jonathan Kuminga After Ejection in Preseason Game

-

Science2 months ago

Science2 months agoChicago’s Viral ‘Rat Hole’ Likely Created by Squirrel, Study Reveals

-

Lifestyle2 months ago

Lifestyle2 months agoDua Lipa Celebrates Passing GCSE Spanish During World Tour

-

Entertainment2 months ago

Entertainment2 months agoZoe Saldana Advocates for James Cameron’s Avatar Documentary

-

Politics2 months ago

Politics2 months agoDallin H. Oaks Assumes Leadership of Latter-day Saints Church